The Flexspace Observatory Bonus Track: Rates Popularity by Coworking Size

A few months ago we analysed flex workspace tenure from different perspectives. During the initial stages of our research, the Nexudus data team works with a large number of records trying to bring you those that are most relevant. Much of the information that is discarded is actually necessary in order to be able to look at an issue from different angles, to be able to confirm the information we send you.

However, in some cases, we find information that may not have the necessary length to create a complete report on that particular topic, but it is impossible for us not to share this with you!

One such insight is the popularity of each type of rate in the flexible workspace industry in general, and in the different types of space by size.

Contracts by rate

.jpg)

In the graph above we see the number of contracts in each type of rate in the sample. This data shows a reality that is hard to dispute: the flexible workspace industry has left behind the coworking industry that we saw evolve at the beginning of the last decade.

The industry has clearly moved from coworking, where the dedicated desk rate was the reigning rate, to an era where offices and Hot Desk dominate the industry landscape: the era of flexible workspaces.

When interpreting the data in the table above we must keep in mind that we are talking about contracts and, in the case of office rates, include, in most cases, more than one member. That is to say: an office for 10 people has only one contract, so the number of members, and square meters dedicated to this service, is much higher than the 33.4% of the contracts shown in the graph.

The percentage of Hot Desk member contracts is practically 50% higher than that of Dedicated Desk members. This figure is not subject to interpretation since each Hot Desk contract corresponds to one member at that rate.

The sector has therefore been dominated, until mid-2021, by spaces with a significant number of occupied offices and a large number of Hot Desk members.

Members on the latter tariff occupy spaces in common areas that are essential to provide good service to members on higher priced tariffs, such as office, or in areas that at different times of the day serve different functions (like events space) or both at the same time.

Flexible workspaces, therefore, opt, on average, for private office contracts that reduce management and for offering hot desks that allow them to monetise spaces such as the canteen or event areas at times when they have little to no use.

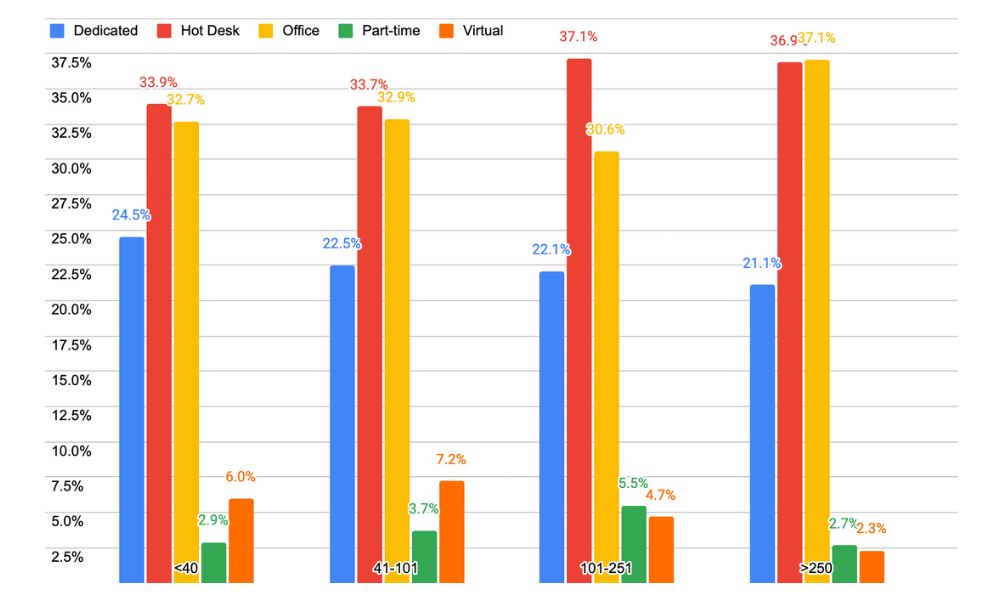

Contracts for each rate by coworking size

When talking about the flexible workspace industry we tend to think of smaller spaces as having more dedicated desk rate members: is that really what’s actually happening? Let's take a look at the chart below.

We can see that spaces with 40 or fewer members have 24.5% of the contracts on dedicated table rates, and, as the size of the space increases, we see how this percentage decreases to 21.1%. In other words, smaller venues have only 16% more dedicated table contracts than larger venues, a figure that, while not negligible, is much lower than one would expect at the outset.

We might have anticipated that the spaces with more than 100 members are the ones that have more members at hot desk rates, but we have found that on average it is 10%. We are not surprised since they have large common areas that they can monetise with members at these rates.

Other insights from the graph that have caught our attention are, for example:

For spaces between 101 and 250 members the percentage of office contracts is about 7% lower than for spaces between 41 and 100 members. The reason for this decrease is probably due to the fact that the office sizes increase and therefore the number of contracts decreases at a percentage level.

In spaces between 41 and 100 members virtual rates represent 7.2% of the contracts and for those of 40 or less members - 6%. This represents an increase of 213% when compared to spaces with more than 250 members, which have a lower value for this fee at only 2.3%. It is clear that smaller spaces sharpen the ingenuity to monetise this fee that can grow practically unlimitedly.

These are some of the insights that have caught the team's attention and we wanted to share them with you, but is there any data that has particularly caught your attention?

On future occasions, we will be able to evaluate how the extreme flexibility of recent years continues to evolve, and how spaces are solving the needs that the market poses to them every few months.

If you found this article interesting, head to the Flexspace Observatory where the Nexudus team analyses real workspace data to bring you reports that can help you further optimise the management of your space!

Related posts

-

Global Coworking Trends and Opportunities for 2025

Now well into 2025, the coworking industry continues to demonstrate strong momentum. With demand for coworking spaces remaining steady around the globe, it's clear that coworking is not just enduring—it's thriving. Let’s explore the major trends and opportunities shaping the global coworking landscape this year.

-

Creating Events that Drive Community Engagement in Coworking Spaces

Community is everything in coworking, but a genuine sense of connection between members doesn’t magically happen overnight or by chance. Often, meaningful relationships take intentionality, effort, and time to build, with events being an effective vehicle for bringing people together around shared interests, goals, and experiences, creating opportunities for collaboration, and a thriving coworking culture. This article looks at creating events that drive community engagement in coworking spaces.

-

Liz Elam: ‘Community is the number one amenity in coworking spaces’

A household name in the global coworking industry, Liz Elam, is the founder of one of the world’s best coworking event series: GCUC. Liz’s coworking roots began in 2010, when she established Link Coworking – a welcoming, affordable, and professional coworking space – in her hometown of Austin, Texas. Link Coworking achieved incredible success, expanding across three locations and becoming the fourth-largest coworking brand in Austin. It was sold in 2019, making Liz the first woman globally to exit a coworking brand.

-

Key Takeaways from the Coworking Alliance Summit 2025

Gathering online for the Coworking Alliance Summit last week, members of global coworking alliances, coworking spaces, and community leaders came together to navigate global issues, strengthen ties across the coworking industry, and work collectively towards future goals.

-

5 Ways to Reduce Noise in Open Offices & Coworking Spaces

Some people like working against a background of noise, while for others it’s their worst work nightmare. The truth is, our relationship with noise depends on our own preferences and the nature of our work.

-

Key takeaways from the Workspace Design Show 2025

London’s Workspace Design Show is undoubtedly one of the best coworking events of 2025. For one, the exhibition (held at Islington’s Business Design Centre) features a host of innovative and creative workspace design solutions tailored to the needs of modern workplaces.